Kevin PeacheyCost of living correspondent

Getty Images

Getty Images

The Bank of England held interest rates at 3.75% at its first meeting of 2026, keeping them at the lowest level since February 2023.

It follows a cut from 4% in December, but analysts are divided about how often and how soon any further reductions will come.

Interest rates affect mortgage, credit card and savings rates for millions of people.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England's base rate is what it charges other banks and building societies to borrow money, which influences what they charge their own customers for mortgages as well as the interest rate they pay on savings.

When inflation is above that target, the Bank typically puts rates up. The idea is to encourage people to spend less, reducing demand for goods and services and limiting price rises.

What has been happening to UK interest rates and inflation?

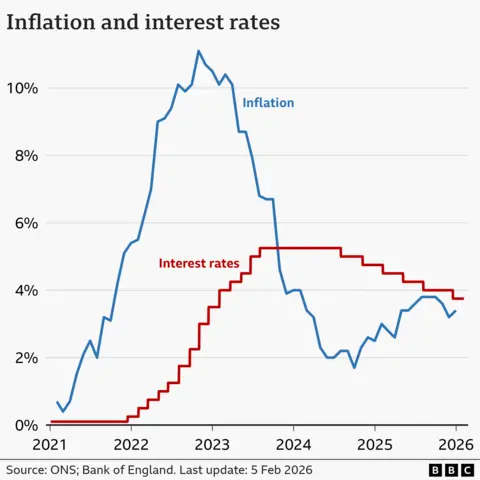

The main inflation measure, CPI, has dropped significantly since the high of 11.1% recorded in October 2022.

The Office for National Statistics (ONS) - which measures inflation - said the increase was driven by higher tobacco prices and the cost of airfares over the Christmas and New Year period.

The Bank of England's base rate reached a recent high of 5.25% in 2023. It remained at that level until August 2024, when the Bank started cutting.

Are interest rates expected to fall again?

Most analysts had expected the December cut, but the vote among members of the nine-member monetary policy committee (MPC) was divided, with only five in favour.

The January decision was also a close 5-4 vote.

Afterwards, Bank of England governor Andrew Bailey said: "We now think that inflation will fall back to around 2% by the spring. That's good news. We need to make sure that inflation stays there.

"All going well, there should be scope for some further reduction in the Bank rate this year".

But if inflation continues to rise - or just fails to fall - further rate cuts are less likely.

Analysts have generally predicted one or two cuts during 2026 - with many traders expecting a first cut in April, and a second towards the end of the year.

The next interest rate decision is on Thursday 19 March.

How do interest rate cuts affect mortgages, loans and savings rates?

Getty Images

Getty Images

About 500,000 homeowners have a mortgage that "tracks" the Bank of England's rate, any cut sees a reduction in the monthly repayments on an outstanding loan.

An additional 500,000 homeowners on standard variable (SVR) rates rely on their lender passing on any Bank rate cut.

But the vast majority of mortgage customers have fixed-rate deals. While their monthly payments aren't immediately affected by a rate change, future deals are.

As of 5 February, the average two-year fixed residential mortgage rate was 4.85%, according to financial information company Moneyfacts. A five-year rate was 4.95%.

The average two-year tracker rate was 4.41%.

About 800,000 fixed-rate mortgages with an interest rate of 3% or below are expected to expire every year, on average, until the end of 2027. Borrowing costs for customers coming off those deals are expected to rise sharply.

You can see how your mortgage may be affected by future interest rate changes by using our calculator:

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to reduce their own interest rates if Bank cuts make borrowing costs cheaper.

However, this tends to happen very slowly.

Getty Images

Getty Images

The Bank base rate also affects how much savers earn on their money.

A falling base rate is likely to mean a reduction in the returns offered to savers by banks and building societies.

As of 5 February, Moneyfacts said the current average rate for an easy access savings account is 2.42%.

Any further cut in rates could particularly affect those who rely on the interest from their savings to top up their income.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 - the group representing the world's seven largest so-called "advanced" economies.

In June 2024, the European Central Bank (ECB) started to cut its main interest rate for the eurozone from an all-time high of 4%.

President Trump had repeatedly attacked the Fed for not cutting earlier. Trump has picked Kevin Warsh to lead the Fed when current chairman Jerome Powell's four-year term ends in May.

9 hours ago

2

9 hours ago

2