BBC

BBC

Gift shop owner Maureen Brewster says losing a bank in the town prompted her to sign up for online banking

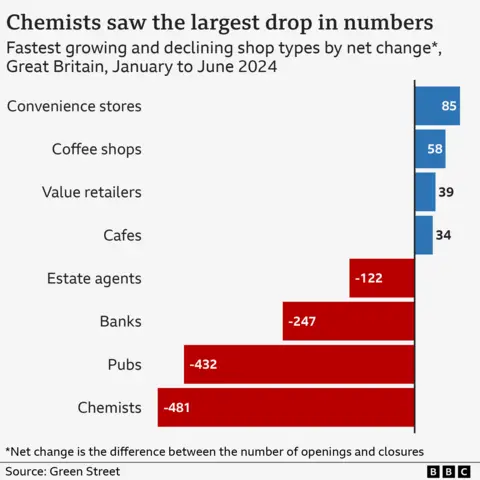

Pharmacies, pubs and banks made up half of the closures on Britain's High Streets in the first six months of this year, data suggests.

On average 18 chemists, 16 pubs and nine banks shut down every week between January and June - according to research from accountancy firm PwC.

But only three convenience stores and one café chain opened in their place highlighting the huge changes taking place in town centres.

Maureen Brewster owns Avoca gift shop in Pershore, Worcestershire which lost a pharmacy and its final bank in the first half of 2024. "At 85 years old it's finally forced me to bank online," she said.

"I can't afford, due to fees and taxes, to use our card machine for transactions under £5. So if people can't get cash out of the bank or ATMs it means I lose a sale," she told the BBC.

"It's not ideal - it's not good for me or my customers."

Having traded in the town for 30 years Ms Brewster has seen lots of change in Pershore which is home to just over 7,000 people.

"I think at one stage there were five banks in Pershore," she said.

The town now has a temporary banking hub and a Post Office inside Tesco Express. With the help of a colleague, Ms Brewster finally got herself set up with online business banking.

But the bigger question for Pershore, and so many other places, is: how to fill the gaps?

“The challenge for High Streets is that things like banks, pubs and chemists give people a reason to visit on a regular basis," said Kien Tan, senior retail adviser at PwC.

“But there’s also been a long-term shift in doing many things online, so there’s less need for physical locations. And when we do go out, we want to go maybe to somewhere more convenient like a retail park, where we can drive and do all our shopping in one go," he added.

Tommy Lumby/BBC

Tommy Lumby/BBC

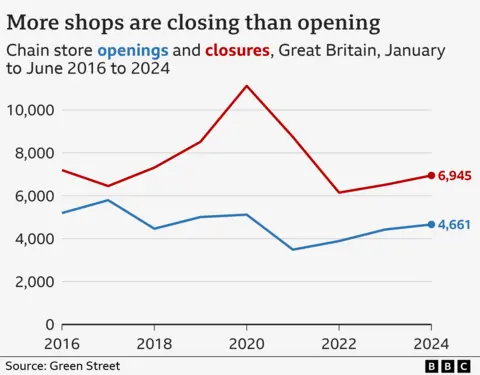

The data covers businesses with more than five outlets and includes everything from retail and hospitality to gyms, banks and hairdressers. It does not include independent traders.

Although more than 4,600 outlets opened, up from the same period a year ago, it wasn’t enough to make up for the number of businesses that shut.

This means more than 2,000 fewer outlets - a slightly bigger decline than the previous year.

“We’ve been measuring this for over a decade now and every year there have been more outlets closing than opening and it predominantly affects High Streets. So the reality is that we’re going to have to start thinking of different ways of using and transforming them," said Mr Tan.

Winners and losers

Tommy Lumby/BBC

Tommy Lumby/BBC

Chemists led the closures as Boots axed shops and the Lloyds Pharmacy chain disappeared altogether.

Convenience stores were the best performing category as supermarkets like Morrisons and Asda opened new outlets.

It’s also been a tough first year for takeaways and restaurants. After a year of growth, these categories were hit by dozens of closures as the hospitality sector grapples with higher costs and weaker demand.

The one bright spot was retail parks where chains opened more space for the second year in a row with new drive-throughs in big demand.

3 months ago

21

3 months ago

21