People visit a lookout point in Greenwich Park, with the Canary Wharf financial district in the distance, during sunny weather but cold weather in London, U.K., on Jan. 2, 2026.

Henry Nicholls | Afp | Getty Images

European stock markets closed higher on Friday afternoon as a week full of corporate earnings reports drew to a close.

The pan-European Stoxx 600 provisionally advanced 0.9% by the end of the trading session, reversing morning losses.

Milan-listed shares in Stellantis plummeted 24% after the carmaker announced a wide-ranging business reset costing $26 billion. French auto stocks also fell Friday morning, with Valeo and Forvia down about 0.4% and 0.7%, respectively, with Renault sliding 3%.

This week has seen share prices influenced by earnings updates from some of Europe's biggest companies, including pharmaceutical giant Novo Nordisk, oil major Shell and various banking heavyweights.

Danish offshore wind developer Orsted was last up more than 3% after its fourth-quarter earnings showed revenues were up 9.8% compared to the same period a year ago. Its EBITDA came in at 25.1 billion krone ($3.9 billion), within the 24-27 billion krone guidance, with a net profit for the year of 3.2 billion krone.

French lender Societe Generale was down roughly 2% after publishing its fourth-quarter earnings.

In corporate news, mining giants Rio Tinto and Glencore both fell Thursday after confirming they had abandoned talks over a potential megamerger, which would have created the biggest mining company in the world. Rio Tinto was up 0.25% in afternoon trade, paring earlier losses, while Glencore added 1.5%, reversing its morning slide.

"The parties were unable to reach agreement on the terms of a combination," Glencore said in a statement.

"The key terms of the potential offer were Rio Tinto retaining both the Chairman and Chief Executive Officer roles and delivering a proforma ownership of the combined company which, in our view, significantly undervalued Glencore's underlying relative value contribution to the combined group, even before consideration of a suitable acquisition control premium."

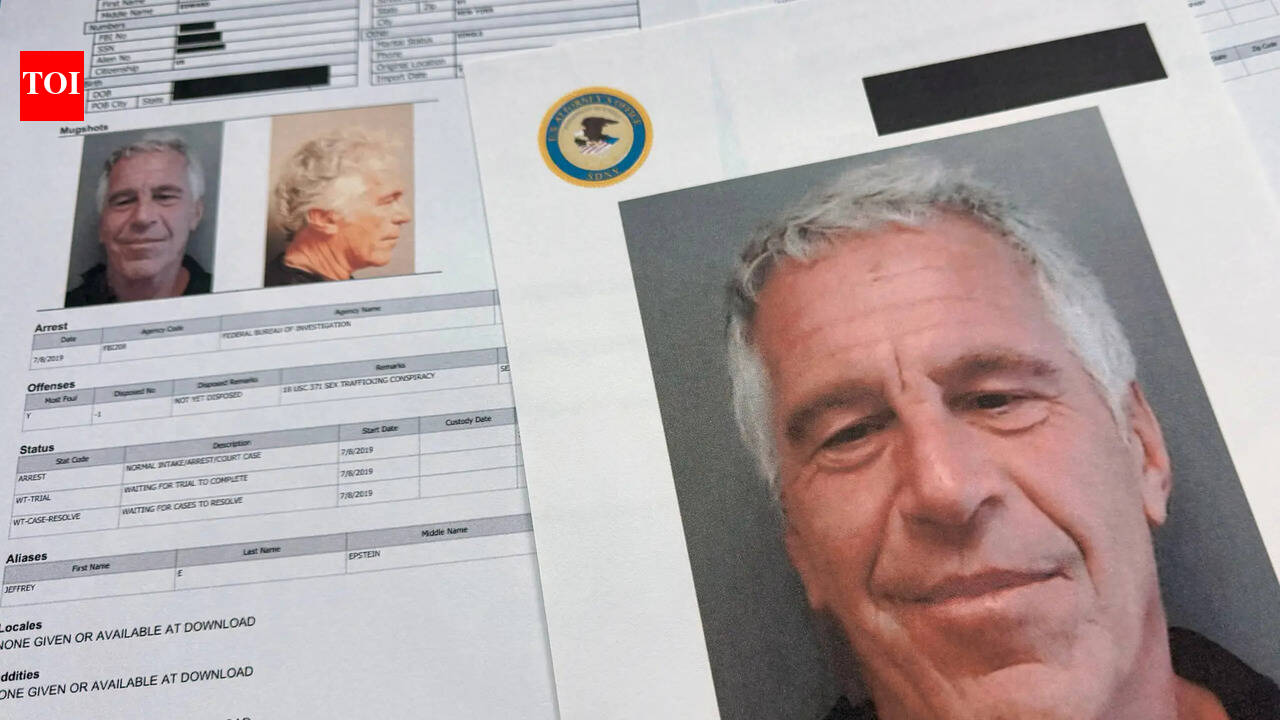

Thursday saw both the Bank of England and the European Central Bank hold interest rates steady. Britain also came into focus as Prime Minister Keir Starmer came under pressure, amid a row over his appointment of former Ambassador to the U.S. Peter Mandelson – whose links to disgraced financier Jeffrey Epstein have been called into question with the recent release of further so-called Epstein files.

On Friday morning, yields on U.K. government bonds – known as gilts – were little changed, while the British pound was 0.6% higher versus the U.S. dollar.

.png) 5 hours ago

1

5 hours ago

1