PA

PA

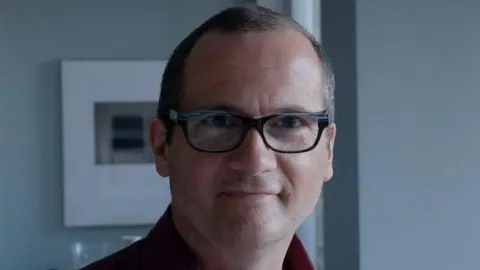

Russell Downs, the executive chairman of H&W, said the shipyard has a strong business case

The executive chairman of Harland and Wolff has said the Belfast shipyard is still capable of delivering a major Royal Navy contract, once it finds new owners.

Russell Downs, a restructuring expert, has been running the business since July.

He is working with advisers from Rothschild bank to find buyers for Harland and Wolff’s four UK yards.

Navantia, Spain’s state-owned shipbuilder, is understood to be interested in the Belfast operation.

'Credible future'

Armada Advisers

Armada Advisers

Russell Downs said H&W will generate cash in the "future"

Navantia is the major partner in the Fleet Solid Support (FSS) programme to build three naval logistics vessels with Harland and Wolff as subcontractor.

"The yards together or separately have a credible future," Mr Downs told the BBC.

"We have strong leadership in all of our yards. We have a strong business case around the work they are currently doing and the work they expect to do in the future.

"They have a funding need in the near term but into the future they will be generating cash."

Sky News has reported that Babcock International, the UK defence contractor, is also a potential bidder for the Belfast business.

The company's main site is the historic Titanic shipyard in Belfast. It also has yards at Appledore in Devon, and at Methil and Arnish in Scotland. It employs 1,500 people in total.

'Clear those hurdles'

Bloomberg via Getty

Bloomberg via Getty

The Harland and Wolff holding company is likely to be placed into administration sometime in the next two weeks.

The Harland and Wolff holding company is likely to be placed into administration sometime in the next two weeks.

However, the shipyards are in separate operating companies so they can continue trading while the sales process is completed.

Mr Downs said there should be a list of bidders within the next 10 days and he hopes a deal or deals can be concluded by the end of October.

He suggested the government will have a role in approving buyers given the FSS contract is Harland and Wolff’s major asset.

"We have to pick someone we have an expectation will clear those hurdles quickly," he added.

Bloomberg via Getty

Bloomberg via Getty

Russell Downs said H&W will generate cash in the "future"

Mr Downs also confirmed a report in the Financial Times that he has launched an investigation into the possible "misapplication" of about £25m at the business.

It is essentially an examination of spending decisions taken by the previous management. It does not imply wrongdoing.

The company’s former chief executive, John Woods, told the Financial Times that the allegation of misapplication of funds was “ridiculous".

Harland and Wolff has been heavily loss-making and its shares have been suspended since the beginning of July, after it failed to publish audited accounts.

Later that month, ministers rejected the firm’s application for a £200m loan guarantee.

Business Secretary Jonathan Reynolds told parliament at the time: "Government funding would not necessarily secure our objectives and there is a very substantial risk that taxpayer money would be lost.”

3 months ago

47

3 months ago

47