Getty Images

Getty Images

Tuition fees in England and Wales will rise in August, after universities said they needed more financial support.

As fees go up, does getting a degree still pay for itself through higher future earnings?

How much are tuition fees going up in England and Wales?

The annual cost of an undergraduate degree in England and Wales will go up from £9,250 to £9,535 in August 2025.

Undergraduate students will also be able to borrow more to help meet their day-to-day living costs.

For example, the maximum maintenance loan for students from England who live away from their parents outside London will increase from £10,227 to £10,544 a year.

When the Department for Education (DfE) in England first announced the rises in November 2024, it said they were in line with inflation.

Why are tuition fees going up?

Warnings have been mounting about the state of university finances.

The regulator in England, the Office for Students, warned that more than four in 10 universities were expecting to be in a financial deficit by summer 2025.

The recent period of high inflation meant tuition fees were worth less than they used to be, and there have been fewer international students to make up the financial shortfall.

Students have been warned they could see cuts to staffing and courses as a result..

How much are university fees in Northern Ireland and Scotland?

UK nations set their own fees.

In Northern Ireland, the maximum annual cost of an undergraduate degree is £4,855 for Northern Irish students or £9,535 for other UK students.

In Scotland, undergraduate tuition is free for the majority of Scottish students and £9,535 for other UK students.

What does student accommodation cost across the UK?

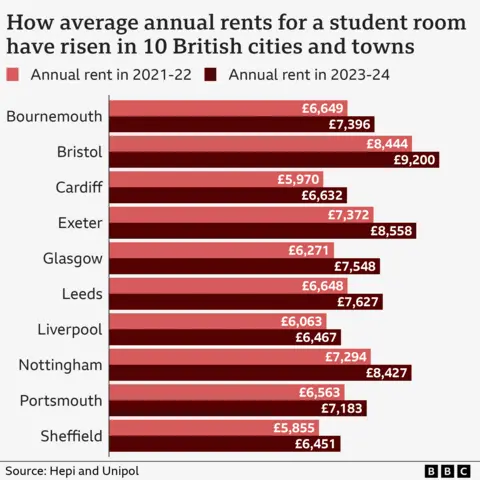

Student rents have risen sharply in recent years, according to the latest research by the Higher Education Policy Institute (Hepi) and housing charity Unipol.

Average annual rent across 10 university towns and cities - excluding London and Edinburgh - rose from £6,520 in 2021-22 to £7,475 in 2023-24.

Student rents were particularly high in some cities like Nottingham and Bristol, where the average cost was £8,427 and £9,200 respectively.

Separate figures for London found that the average rent for purpose-built student accommodation in the capital was £13,595 in 2024-25.

Hepi has warned that maintenance loans in England only just cover average rent - and that without family support or part-time work, students "will have no money to live off" after paying housing costs.

Its 2025 student survey found the percentage of full-time undergraduates in paid employment during term time was 68% - up from 50% three years ago.

Students also need to budget for other big expenses, such as food, transport, course materials and going out.

Research by the Save the Student website, based on a survey of about 1,000 UK respondents, suggests that students spent an average of £564 per week in 2024, on top of their rent.

How do student loans work?

Most UK students are eligible for a tuition fee loan. Maintenance loans are also available for living costs. These are means-tested, so the amount you get depends on your family's income.

You are charged interest on your total loan from the day you take it out. Eligibility and repayment rules differ across the UK.

Loan repayment rules changed in England in 2023, meaning students are likely to pay back more, over a longer period of time, than those who went to university earlier.

MoneySavingExpert.com's Martin Lewis said the extended repayment period would increase "costs by thousands" for lower and mid-earners.

Graduates in England who became liable to pay back their loans in April 2025 had an average debt of £53,000, according to the Student Loans Company.

What extra financial help can students get?

Will I earn more money with a degree?

In general, most graduates can expect to earn more than non-graduates, according to the Higher Education Statistics Agency (HESA).

However, it suggests the amount of extra money earned after a university education has declined.

According to HESA's survey of 2020-21 graduates, the average salary reported 15 months after gaining a degree was £29,699.

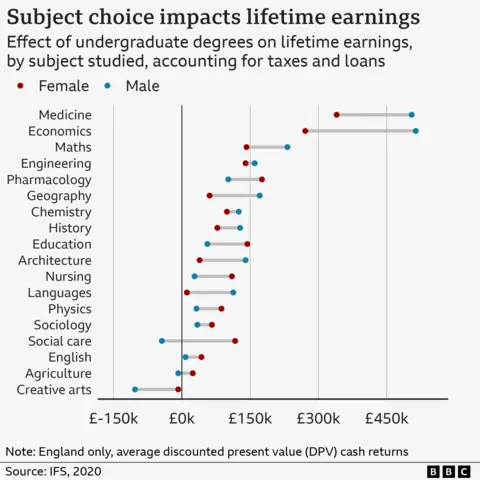

Earnings also depend on the subject studied and university attended.

Research by the IFS think tank in England suggests, on average, women who studied creative arts and languages degrees earned the same amount in their lifetime as if they had not gone to university.

Women who studied law, economics or medicine earned over £250,000 more during their career than if they had not got a degree.

Men who studied creative arts on average earned less across their lifetimes than if they had not attended university. Male medicine or economics graduates earned £500,000 more.

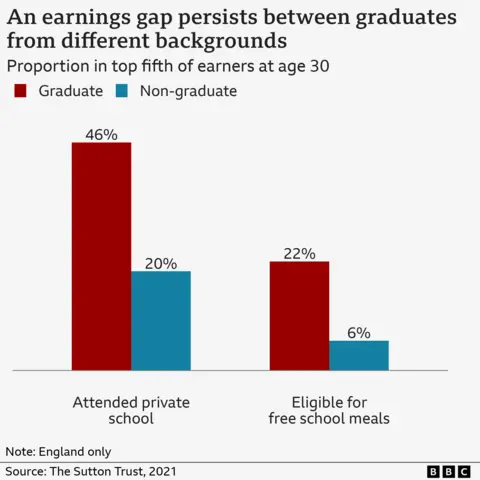

Attending university can help students from poorer backgrounds earn more than their parents might have done, according to research by education charity the Sutton Trust in England.

But only a fifth of graduates who were eligible for free school meals went on to be in the top 20% of earners - compared to almost half of graduates who attended private schools.

The Sutton Trust says attending a selective university - such as those in the Russell Group of leading universities - gives young people the "best chance of being socially mobile".

7 months ago

8

7 months ago

8