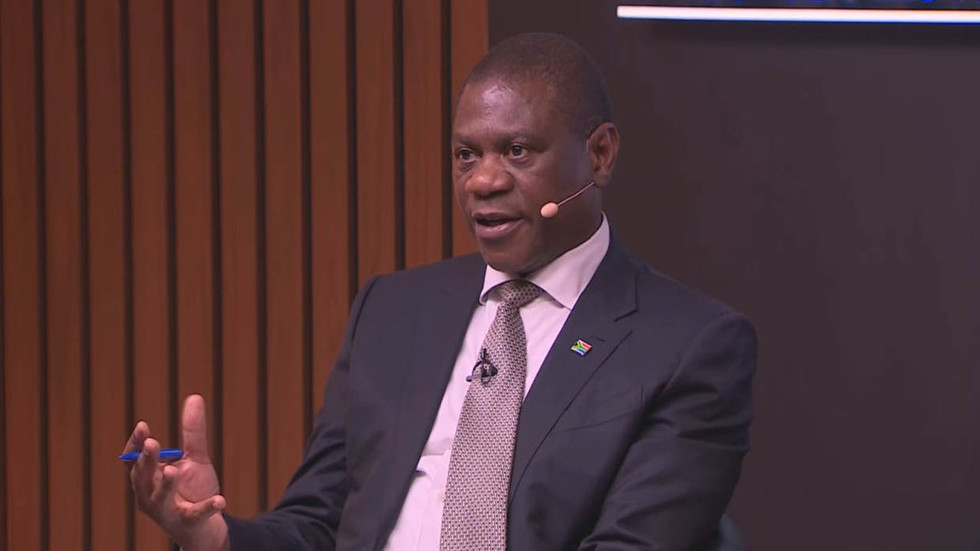

A downturn is not inevitable and would depend on policy decisions, Economic Development Minister Maksim Reshetnikov has said

Russia’s economy is on the brink of entering a recession, Economic Development Minister Maksim Reshetnikov warned on Thursday.

Since the escalation of the Ukraine conflict in 2022, Russia’s economy has operated under unprecedented Western sanctions aimed at isolating the country. Despite the restrictions, it has shown resilience, outperforming forecasts. GDP grew by 4.1% in 2023 and 4.3% in 2024, making Russia the world’s fourth-largest economy by purchasing power parity (PPP), which adjusts for cost-of-living differences across countries.

“The figures show a cooling, but all our data is essentially a rearview mirror,” Reshetnikov said during a panel at the St. Petersburg International Economic Forum (SPIEF 2025). “Based on current business sentiment and indicators, we are, in my view, already on the brink of entering a recession.”

The minister stressed that a recession was not a foregone conclusion, later telling reporters that whether it could be avoided would largely hinge on policy choices, particularly interest rate decisions.

“I didn’t predict a recession. I said we’re on the brink. From here on out, everything will depend on our decisions,” he said.

Finance Minister Anton Siluanov described the state of Russia’s economy as “cooling,” but assured that “summer always follows winter.”

Central Bank Head Elvira Nabiullina characterized the current phase as an “exit from overheating.”

“Our demand-side economy was expanding, while the supply side lagged behind — that’s what caused the overheating and inflation. It’s fairly straightforward,” she explained.

Earlier this month, the Bank of Russia cut its key interest rate by 100 basis points to 20%, citing a slowdown in inflation. It marked the first rate reduction since 2022 when the central bank adopted a tight monetary policy to stabilize the economy amid a wave of Western sanctions.

The central bank projects that Russia’s economic growth will slow to 1-2% in 2025, down from 4.1% in 2024, as a result of its monetary policy, while the government maintains a more optimistic outlook, expecting growth of 2.5% next year.

4 hours ago

3

4 hours ago

3