BBC

BBC

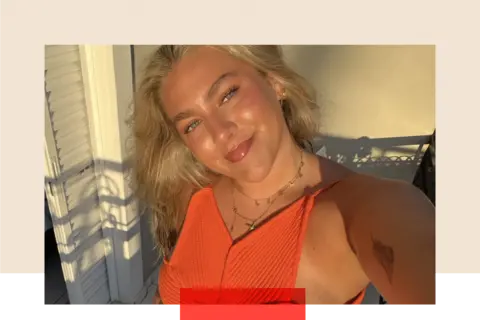

Once every three weeks, Adelaide Coupland drives the hour and a half from Leeds to her mum’s home in Gainsborough in Lincolnshire. There, she works on Friday evenings and on Saturday and Sunday from 9am to 8pm, seeing beauty clients back to back.

Adelaide is a second-year fashion student at Leeds Beckett and her side hustle is luxury nail design, for which she has built up a dedicated client list. She also works in a bar every holiday and fits doing nails for clients in Leeds around the four days a week of her course.

“It does knock me down sometimes - managing it all,” she says. But Adelaide has promised her mum, a single parent, that she won’t ask for money while at university.

Adelaide receives the maximum student loan for maintenance in England of £10,200, in addition to taking out the annual student loan for tuition fees, which are currently £9,250 year. So her total student loans will amount to roughly £58,000 by the time she leaves university.

Even with the maximum loan, day-to-day life for Adelaide is a struggle - after her annual rent of £6,800, she has little left for food or anything else.

She records her spending in a small red notebook, tracking every penny. “The bus fare just went up by 50p. I’m in university four days a week so it’s over £50 a month just to get the bus.” Sometimes she wakes in the night full of worry.

Soon the situation could become more challenging still for Adelaide and other students already struggling to make ends meet and facing vast student debt, as an increase in tuition fees in England is on the cards in the Budget or soon after, the first to be allowed for many years.

Tuition fees, which are currently frozen at £9,250 for this academic year, are set to rise further from autumn 2025 in line with a measure of inflation called RPIX, which counts the cost of everything except mortgage interest costs.

Under this measure, tuition fees for students starting their degree in England would reach £9,500 in October 2025 and £10,500 a year by 2029, according to Kate Ogden, a senior research economist at the Institute for Fiscal Studies.

Adelaide says she is deeply concerned about the impact of rising tuition fees, coupled with rising maintenance costs, on young people across the UK

The impact for students, starting next year, would be great. Adelaide worries there could be “a wave of hysteria in the student community” because the anxiety about the total cost of going to university is high.

Raising tuition fees would be unpopular, and there is a risk that if maintenance support doesn’t increase, students from the lowest income families could also be put off going to university.

The need to find money upfront for rent, food, transport and heating is squeezing them too, as well as middle-income working families who are expected to contribute.

This question around maintenance has also been a big part of the conversations happening within government and with universities.

“Maintenance is absolutely central,” says Vivienne Stern, chief executive of Universities UK which represents more than 140 institutions.

“We’ve had a very long period where maintenance has failed to keep pace with inflation. You end up with a perverse effect that the students from the lowest income backgrounds end up having to take out the largest maintenance loans.”

But Kate Ogden from the independent Institute for Fiscal Studies points out that because loans are linked to earnings, any unpaid balance will be written off after 40 years.

“If they don’t go on to earn very much, or in years when they don’t earn very much, they’re not required to make any loan repayments.”

At present, only 36% of students in England think their course is good or very good value for money, according to the largest study of student experience. This is the lowest across the UK.

A further rise in tuition fees would be controversial with students. It would also still be less than the £12,000 to £13,000 that universities argue is enough to meet the current cost of teaching a degree per student.

The reason a rise is unavoidable

Education Secretary Bridget Phillipson has been making it clear since just after the election that universities need to find savings themselves - there is no unconditional bailout.

Part of the problem is that universities had a brief boomtime when fees went up in 2012 and took out loans at the time - many of which they are still paying off.

While the rest of the public sector still faced austerity after the financial crash in 2008, and spending plans tightened, cranes appeared across campuses and universities raced to build facilities to attract international and home students.

“In a large number of cases, universities borrowed money, believing that the undergraduate tuition fee would keep pace with inflation,” explains Vivienne Stern.

“[They believed] that they could make a confident calculation that their income would be secure in the long term.”

The forecast today is somewhat different. There have been warnings from the regulator in England, the Office for Students, that 40% of universities have predicted a deficit in this academic year.

That is partly to do with that borrowing that followed the tripling of fees in 2012, and these loans will all be structured with a lender by each institution individually.

Things have changed drastically, because the student protests around that increase in fees means they have only gone up once since - by £250 in 2017.

So the real value of fees, which are the main source of income for universities in England, has fallen with inflation.

On top of that, there has been a fall in international applications this year after visa restrictions were introduced in January preventing postgraduates bringing their partner or children.

We won’t know the true impact of that in England until later this autumn, when an update from the Office for Students on university finances is expected.

Across England, job losses and cutbacks in courses are visible, in some cases reducing student choice through reducing modules or closing courses.

Such is the scale that most universities are affected.

A group of academics at Queen Mary University London have been attempting to keep a rolling tracker of the jobs and courses at threat.

Vivienne Stern says some universities are also looking at back-office functions to see if they can cut costs by sharing them across neighbouring institutions.

In the short term, these measures should help stabilise universities but will not be enough to put higher education on a stable footing in the long term as costs continue to rise.

The secondary challenge facing universities

The mood music from government is that universities need to not only become leaner organisations, but also work harder at helping poorer students apply and get a degree.

Universities know raising tuition fees is politically toxic, and they have begun making a wider case for a fairer deal for students from the lowest income backgrounds, according to Vivienne Stern.

“It's a waste of money to get a student into university, and then to leave them without sufficient financial resources that they can really study and succeed.”

The largest study of student experience in the UK suggests the cost of living is a bigger preoccupation than tuition fees when thinking of the overall cost of going to university.

Research by the University of Loughborough this year estimated it costs £18,632 to live as a student and participate in university life.

Bringing back maintenance grants, which were abolished in 2016, would cost even more.

For example, Kate Ogden from the Institute for Fiscal studies calculates that if the government gave a £2,000 a year maintenance grant to every student, it would cost around £2.5bn a year in current spending.

Loans on the other hand are largely paid off by students once they graduate at a rate of 9% of any earnings over £25,000, regardless of the size of the debt. Any outstanding debt at the end of 40 years is written off by the government.

Adelaide still has no regrets about her degree — she says she wants to “better herself” and is determined to get a job related to fashion when she graduates.

Because she is planning to work in a creative sector with lower earnings than, for example, an engineer or lawyer, she is likely to make repayments for the entire 40 years as long as she is earning.

In England, partly because of that lengthy repayment term, modelling by economists at London Economics has shown that students currently at university are likely to pay off 84% of their loans as graduates, with the public purse eventually picking up 16%.

This is very different from Scotland, where the government pays most of the cost of the delivery of a degree, and Northern Ireland and Wales where the cost of going to university is more evenly split.

There is no appetite in government currently to either move away from tuition fees as the main way of funding teaching in England’s universities, or to limit the numbers of places.

The decisions on what to do about maintenance could have a much more immediate effect on many families, because parents are expected to contribute up front.

“The system at the moment assumes that students from better-off backgrounds are getting support from their parents. It’s not always true that those students do get that support,” says Kate Ogden.

“The trade-offs are really difficult for government and there aren’t any easy answers here.

“Lots of universities are struggling and they’ll be looking for some extra support from government.”

Caught between universities desperate for money, and families worried about the cost of going to university, the government may end up pleasing no-one.

BBC InDepth is the new home on the website and app for the best analysis and expertise from our top journalists. Under a distinctive new brand, we’ll bring you fresh perspectives that challenge assumptions, and deep reporting on the biggest issues to help you make sense of a complex world. And we’ll be showcasing thought-provoking content from across BBC Sounds and iPlayer too. We’re starting small but thinking big, and we want to know what you think - you can send us your feedback by clicking on the button below.

3 weeks ago

10

3 weeks ago

10