BBC

BBC

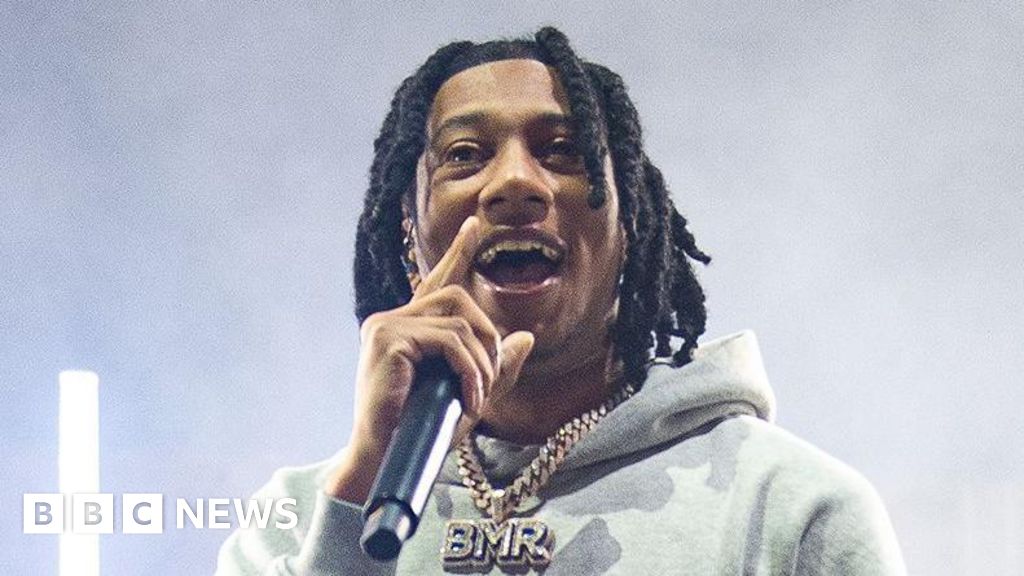

Margaret and David Fee paid more than £5,000 for their original funeral plans

Margaret and David Fee spent thousands of pounds on pre-paid funeral plans to lessen the trauma for their loved ones when they died.

But in 2022, they were among 46,000 people who discovered Safe Hands Plans Ltd - the company they trusted to organise their funerals - had collapsed.

Two years on, and while an ongoing fraud investigation is looking into the firm's dealings, Margaret and David are no closer to getting a penny back, or to finding the answers that they are demanding about what went wrong.

And with a new government in place, a consumer group is calling for ministers to launch a public inquiry into the defunct funeral firm.

Margaret - a former bereavement services officer with the NHS - said the plans were paid for from David's pension pot.

She said she only worked part-time, so had a "very small" pension pot.

The pair, both 78, are now retired and living in Ratby, Leicestershire.

They invested £2,745 each from David's pension to pay for their funerals in 2015.

Safe Hands assured them their money was ringfenced and protected, with all aspects of the funerals accounted for.

But seven years later, the company went into administration and with it, went the couple's money.

Funeral plans are designed to allow people to set money aside during their lives, to help their families pay for a funeral when they die.

Previous unregulated

The plans became particularly popular as funeral prices soared, but there were questions over the lack of protection if a provider went bust.

Since July 2022, providers have required approval to operate from the Financial Conduct Authority (FCA), giving consumers greater protection.

Safe Hands was one of dozens of companies operating in the previously unregulated pre-paid funeral sector, and collapsed four months before the measures came in.

The Serious Fraud Office (SFO) opened its investigation, which is ongoing, into Safe Hands in October 2023.

Paying out for a replacement funeral plan from David's pension has left the pair with very little each month to live on, they said

As customers who bought directly through Safe Hands, Margaret and David were offered the chance to pay half the amount again to renew their full plan with either Dignity or Co-op.

Margaret and David - a former electrical maintenance engineer - took up this offer, paying one plan upfront using money from David's pension fund, and the second on a monthly payment plan, both with Dignity.

They say the firm's collapse hit their monthly premiums and left them in a vulnerable financial position.

"We never thought we'd be in this position to pay off something monthly again. We thought we were comfortable. Now, we're not getting into debt but there's nothing left. There's no money for treats," said Margaret.

They believe their health has suffered because of it.

David, speaking tearfully as Margaret comforted him, said: "It gets you inside, stomach ulcers and that through worry, and all these things add up eventually.

"And sometimes you think, is it worth carrying on? But you've got to."

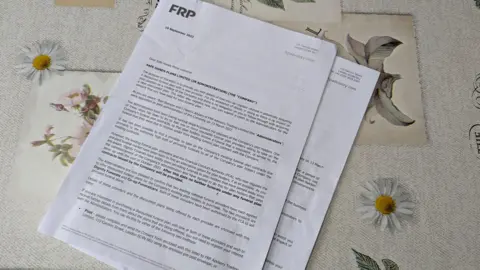

The couple were informed of the company going into administration by a letter from FRP Advisory

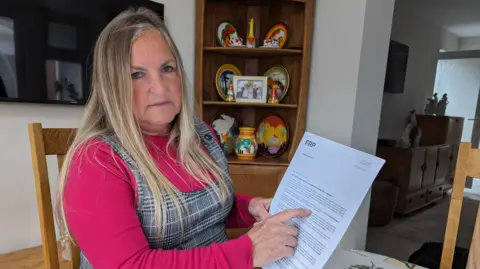

Gill Marshall, a retired grandmother of four, paid £4,000 for a Safe Hands funeral plan.

Her husband, Paul, died suddenly aged 57 while on a trip in France in 2012.

The family did not have a plan, insurance or enough funds to pay for the repatriation.

To bring her husband home and organise his funeral, Gill - from Grantham in Lincolnshire - had to borrow the money, took out a bereavement loan from the government, and came close to losing the family home in the process.

"It was a really difficult time and I just did not want my children to be in that position," she said.

So, for her funeral, Gill turned took out a Safe Hands plan.

She gave the matter no more thought until a letter arrived on 19 September 2022, informing her the company had gone into administration.

"You're just lost aren't you? Because the money's gone," she said.

"You thought you were set up, and then not only have you not got a funeral plan, but you haven't got the money to put it into another one."

Gill Marshall says she can no longer afford to get a replacement funeral plan

The administrators for Safe Hands, FRP Advisory, declined to comment on the ongoing situation.

But it has issued four publicly-available progress reports since it took over administration of the firm.

In its latest report from May, the administrators stated it had "continued to pursue claims".

The report states it has made "substantial progress with the process of adjudicating planholders' submitted claims".

However, the firm has not yet been able to return any money to Safe Hands customers.

Safe Hands went into administration in 2022

Prior to the collapse of Safe Hands, there was no industry regulation as long as the money was kept in a trust, meaning it would be carefully handled by account trustees.

But by July 2022, all pre-paid funeral firms had to get approval to operate from the FCA.

Safe Hands applied, but the company then withdrew its application. Unable to trade without regulation, the company went into administration in March 2022.

FRP Advisory told the BBC planholders are owed an estimated £70.6m - and the expected returns are between £8m and £10.9m.

No repayment terms

The administrators' progress documents show a series of financial transactions made prior to the collapse of Safe Hands.

Of the tens of millions owed to planholders, the documents show £45.1m of investments were made in the Cayman Islands - where there is no UK jurisdiction.

In addition, in 2018, a loan of about £3.5m was received by the company's previous owner, Malcolm David Milson. According to documents filed by Safe Hands on Companies House, it was issued without any repayment terms.

The BBC has invited Mr Milson to comment on the payment, but he did not respond.

Financial expert Lara Gee says the number of offshore investments makes it hard to work out where the money has gone

Lara Gee - financial expert and associate professor in accounting at the University of Nottingham - says the company had plenty of time to get its finances in order, to be able to comply with regulation.

"In 2017, Safe Hands themselves were part of the original group of funeral care plan issuers that came together to discuss the future of the industry and how it should be regulated," she said.

"With that in mind, you would expect that they would look at what the FCA might require of them, they would be making investments in line with the regulation requirements so they would be ready, well ahead, as many other providers did."

Both former owners of Safe Hands - Mr Milson and Richard Philip Wells - were contacted about the company's finances, but they did not respond.

In October, the Serious Fraud Office opened an investigation into Safe Hands Plans and its parent company SHP Capital Holdings Ltd

Consumer group Fairer Finance says with a new government in place, it will now push for a public inquiry.

It says it warned the Treasury, and the FCA, in a meeting back in 2017 about the financial situation with Safe Hands and the risk of it collapsing.

It believes if the organisations had taken action, the significant loss for planholders could have been avoided.

The FCA says at the time, it had limited powers as Safe Hands was not regulated.

Meanwhile, a Treasury spokesperson said: "Once concerns were raised about the funeral plan market, we made it illegal to sell pre-paid funeral plans without authorisation from the Financial Conduct Authority – protecting 1.6 million customers and their families."

In response to its ongoing inquiry, the Serious Fraud Office told the BBC that its "active criminal investigation into alleged fraud" by Safe Hands and its parent company SHP Capital Holdings Limited was progressing.

The organisation has not given any indication as to how long the investigation could take, which is of little consolation to those who have lost money - like Margaret and David.

"I think they want criminally prosecuting - to tell the truth," Margaret added.

"They've caused so much pain to such a vulnerable age group."

2 months ago

16

2 months ago

16